Using artificial intelligence and machine learning technologies, it offers a wide range of services from detection of suspicious transactions to reporting, alarm management to network analysis.

With its user-friendly interface, dynamic data model and advanced authorization management, it supports organizations to adapt to regulatory requirements and increase their operational efficiency.

Datactive AML undertakes the mission of protecting the security and integrity of financial institutions, helping them to easily manage even the most complex compliance processes.

1. Detection and Notification of Suspicious Transactions

Datactive AML is an innovative software developed to enable financial institutions to detect and report suspicious transactions. Thanks to the artificial intelligence-supported scenario creation feature, it analyzes complex financial transactions and determines potential risks quickly and effectively. When suspicious transactions are detected, the system automatically generates alarms and has the ability to assign these alarms to the relevant personnel in batches. In this way, financial institutions can immediately intervene in suspicious activities and minimize possible losses.

The process of creating suspicious transaction notifications is extremely easy and fast with Datactive AML.

Thanks to its user-friendly interface, it becomes simple to create suspicious transaction reports from alarms.

The staff can make their final decisions by changing the alarm status or by making detailed examinations, taking into account the recommendations offered by the system.

These features help financial institutions meet regulatory compliance requirements.

The system helps to avoid possible penalties.

2. Creating an Artificial Intelligence-Supported Scenario

Datactive AML uses artificial intelligence and machine learning technologies to track financial transactions more effectively. Thanks to these technologies, users can easily create even the most complex scenarios using drag-and-drop methods. The system generates dynamic and adaptive scenarios using machine learning models, as well as specific rule-based scenarios. In this way, a proactive approach is taken against constantly changing threats.

In the process of creating a script,

Users can design customized scenarios using different parameters and data sets.

The flexibility offered by Datactive AML allows organizations to develop scenarios that best suit their needs.

In this way, the alarms generated by the system contain fewer false positives and allow real threats to be detected faster.

3. Alarm Management and Personnel Assignments

Datactive AML offers a comprehensive alarm management system to effectively manage suspicious transaction alarms. This system ensures that alarms are assigned to the relevant personnel in bulk, so that each alarm is guaranteed to be handled quickly and accurately. Staff can update alarm statuses in real time and monitor progress, which improves coordination and efficiency.

The system uses intelligent assignment algorithms to distribute the workload of the staff in a balanced way. These algorithms ensure that alarms are assigned to the most appropriate people, taking into account the competence level of each staff member and the current workload. In this way, the alarm management process is carried out more regularly and effectively.

4. Reducing the False Positive Rate with Machine Learning

Datactive AML provides higher accuracy in suspicious transaction detection with machine learning support. The system continuously improves itself by analyzing past alarms and their consequences in order to increase the accuracy of future alarms. This significantly reduces the false positive rate, helping staff to focus on real threats.

The system adapts itself according to the feedback of users and becomes smarter with each new data set.

Thanks to this, financial institutions encounter fewer false alarms and can use their resources more efficiently.

Machine learning models play a major role in detecting new and unexpected threats.

Thus, institutions are always one step ahead.

5. Easy Integration, Advanced Reporting and Authority Management

Datactive AML provides easy integration with existing systems thanks to its dynamic data model. This flexibility allows organizations to quickly incorporate the software into their infrastructure. The natural integration of Datactive AML with the ThothBI Business Intelligence system allows all reporting operations to be managed through a single platform.

Advanced authorization and authorization support is strengthened by the role-based authorization infrastructure. Thanks to this, each user can only access and process the data for which he is authorized.

Users can easily select the data they want and prepare detailed and customized reports. This feature accelerates decision-making processes and contributes to the development of more informed strategies.

Datactive AML‘s reporting and authority management capabilities support financial institutions to adapt to regulatory requirements and improve their operational efficiency.

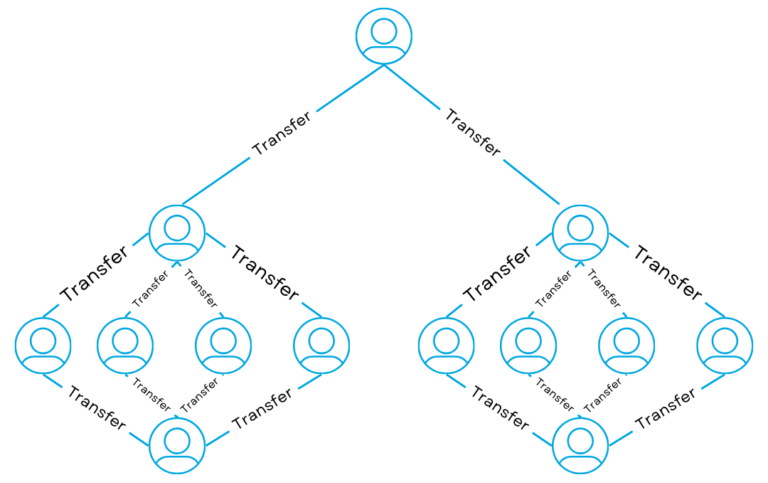

6. Network Analysis and Uncovering Hidden Connections

Datactive AML has advanced network analysis capabilities to analyze the interactions of internal and external customers. This feature allows detecting groups of customers acting in an organized manner and revealing hidden connections. Thanks to interactive network analysis methods, complex relationship networks are visualized and analyzed, which makes it easier to detect fraud and other illegal activities.