Financial operations are changing radically along with financial technologies. On the other hand, compliance management must be considered during this development process. We are discussing the future of financial crime compliance.

Financial operations are changing radically along with financial technologies. On the other hand, compliance management must be considered during this development process. We are discussing the future of financial crime compliance.

AML compliance management may be challenging for some reasons, but there are some solutions to overcome these difficulties.* Let’s discuss the key points of AML compliance once necessary conditions are provided.

AML officers have critical individual duties in AML compliance management processes, and these duties induce some challenges.

We previously mentioned the importance of integrated RegTech Systems. In this article, we discuss the technologies that an integrated RegTech system must include.

We mention RegTech in our previous post. In this article, we will discuss the importance of an integrated approach to regulation technologies.

The increase in complexity of legal regulations paves the way for the technologies customized for this field.

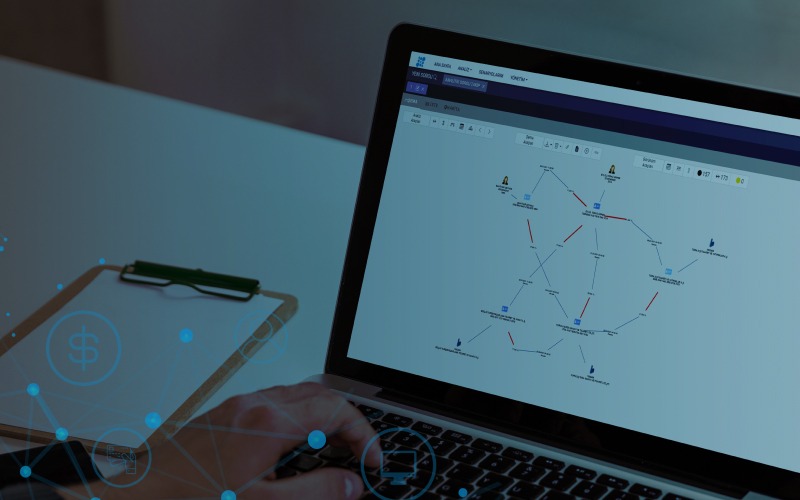

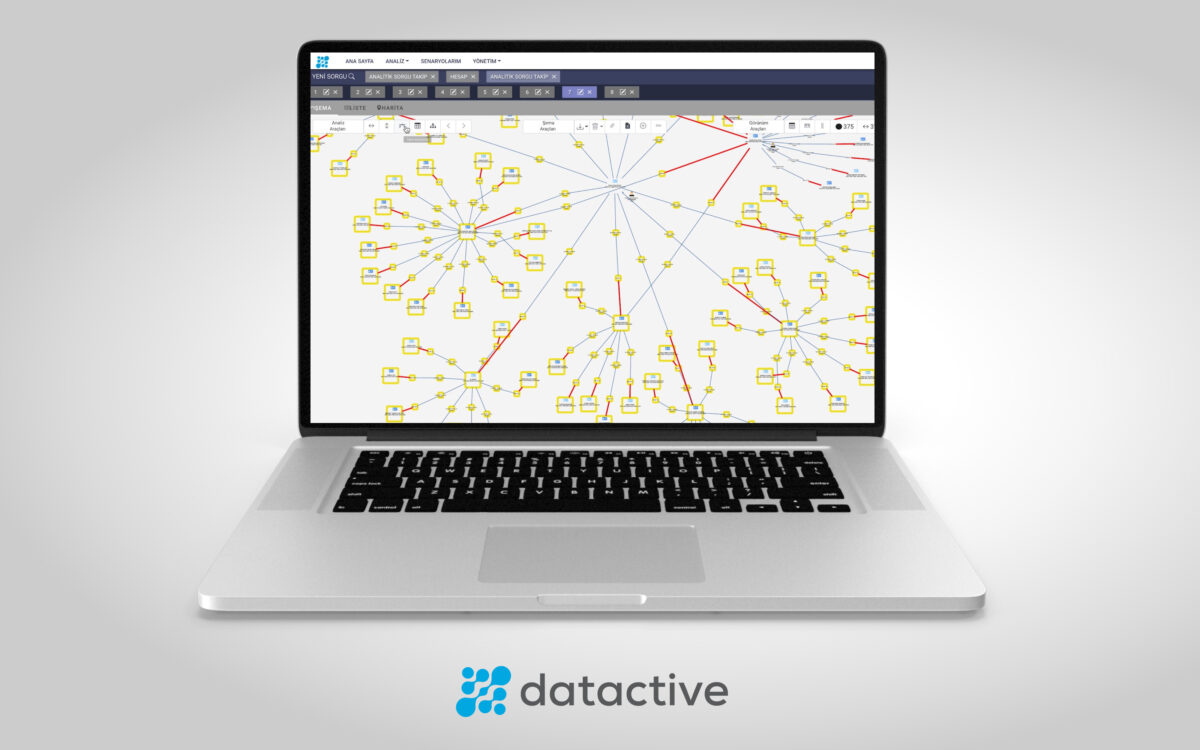

Money launderers can hide well to depict their transactions as legal. However, Datactive reveals hidden connections and patterns in data instantly, so crime rings are no longer invisible.

Many organizations take advantage of artificial intelligence and machine learning solutions. In this article, we discuss how graph technology empowers machine learning processes.

If financial crime organizations are not detected, they cost serious reputational damage and sanctions. The solution is a comprehensive crime intelligence system.

Financial crime intelligence systems differ from rule-based transaction monitoring systems, which monitor the transaction and cancel the transaction if fraud is suspected. In this article, we will examine the differences between them.