If financial crime organizations are not detected, they cost serious reputational damage and sanctions. The solution is a comprehensive crime intelligence system.

Which Activities Are Within the Scope of Financial Crime?

Money laundering, financing of crime and terrorism, insurance fraud, sanction lists, stolen credit cards, internal fraud, online betting and gaming fraud, money transfer, and payment fraud are common financial crime methods. An advanced intelligence system is required for the detection of such organized and large-scale crimes. These types of organized financial crimes usually have the following four characteristics:

• There is an organized group behind all criminal activities and they are planned.

• They prefer indirect methods to avoid being detected by the systems.

• However, they always leave their digital footprints.

• They discover new methods.

Deficiencies of Rule-Based Transaction Monitoring System for Detection of Financial Crime Organizations

Financial institutions generally use rule-based transaction monitoring systems for fraud detection. Members of criminal organizations are experienced to bypass rule-based transaction monitoring systems. Therefore, it can be very difficult to detect the traces or relationships of suspicious people through these systems. Datactive provides a powerful solution for the visualization of complex networks and detection of hidden patterns embedded in internal, external, structured, and unstructured data.

The working mechanism of these systems is as follows: the system creates profiles for each client in accordance with their previous activities. If the system detects any unusual activity that does not match the client’s profile in a transaction, it provides real-time alerts. Triggers of warnings may be a transaction of a large amount of money to an account that the client has not transferred such amount money before, or maybe an unusual credit card transaction. These systems can prevent fraud or account takeover. However, rule-based transaction monitoring systems are not sufficient to detect organized financial crimes because;

• They can only detect problems in a single transaction.

• There is a high probability of false warnings.

• Advanced organized crime rings are more likely not to be caught as they base their strategy on bypassing these systems.

• Organized criminals build their strategies on bypassing these systems.

• A member of the crime network may be a company employee and know the inner workings of the company. Therefore, he or she may be experienced in bypassing the system.

Why is Advanced Crime Analysis System a Requirement?

As we mentioned, organized criminals act agile and may prefer clever methods to avoid detection. To defend, it is necessary to be acquainted with these methods and think like criminals. Illegal activities are rarely managed by a single person. A complete solution to the problem is possible by detecting and eliminating the entire network. Datactive provides analysts with insight into criminals’ plans. Therefore, it allows analysts and field experts to be experienced in criminal methods. Datactive is used by critical organizations as an intelligence analysis system, supports analysts and field experts to transform data into intelligence, and intervenes in cases in almost real-time.

In the investigation and detection of financial crimes, Datactive generally provides the following benefits:

• Reveals attempts to organize financial crimes such as money laundering and financing of terrorism.

• By creating a scenario, the system alerts if any case that matches the scenario is detected.

• Detects illegal activity earlier between complex and suspicious networks.

• Supports analysts and field experts to focus on the right people and achieve results without wasting time.

• Helps to comply with legislation and meet obligations.

Where Does the Data Come From?

Criminals carry out their illegal activities indirectly to hide from detection systems. Therefore, unusual patterns may not appear in a single data source or type. Being able to connect to many data sources is very important for financial crime investigations. It is very crucial that the system should process data from different sources.

Warnings That Initiate a Financial Crime Analysis

If criminals can hide so well, you probably wonder about the warning mechanism that initiates the investigation, or where to start to analyze? The result that the investigator aims to reach is the most important point that guides where to start. Generally, the following situations initiate an investigation;

• A need for further analysis: when the rule-based system warns, but the problem is not completely determined by this system.

• Testing known or suspicious scenarios on the system gives clues.

• If there is a known suspicious person or situation, the investigation can be started and expanded by creating a scenario directly on this person or situation.

The Power of Entity-Link Analysis

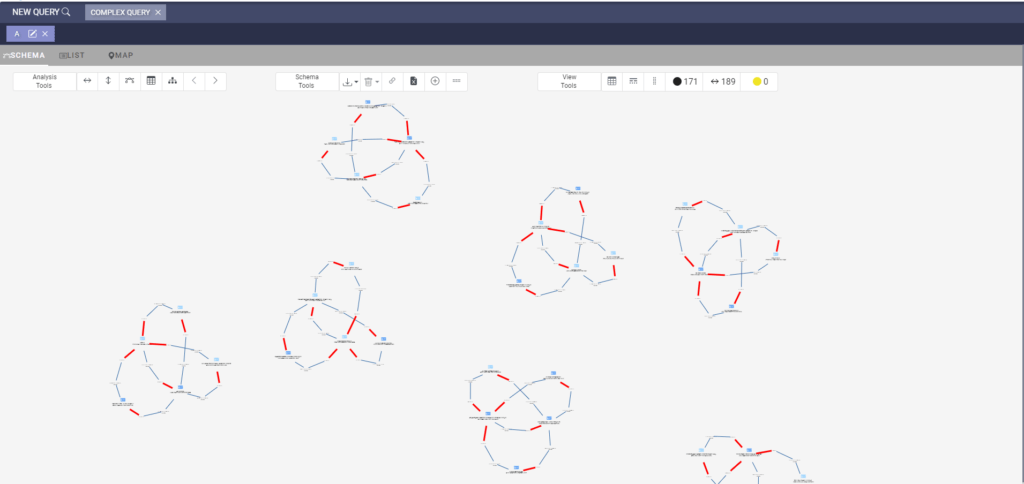

Every person, every transaction, every action, briefly everything, in any case, is connected. The entity-link analysis is the most effective way to demonstrate the relationships between these connections. This visualization method enables analysis of the connections between nodes and is very effective for organized crime detection. Relationships, people, transactions, organizations, and all other entities can be defined as various node types. Displaying all these connected nodes and edges on a single interface, revealing connected people, and detecting suspicious patterns make entity-link analysis an effective method for financial crime investigations.

Considering the customers and transaction volumes of the banks, the number of possible connections may reach billions. Manual tables or relational databases are not able to run such large numbers. Hence, when relationship-oriented data analytics combines with field experiences, it becomes very effective for the detection of patterns that may be an indication of illegal activities. Since the human brain comprehends visuals more than texts, converting the scenarios into visuals allows the results to be discovered easier. Attributes of entities and relations and filters can be defined considering the scenario. In addition, the system allows the creation of dynamic rules for each entity and link. Visual results can be saved and shared with co-workers.

The expansion features of the entity-link analysis screen allow users to follow clues, eliminate unnecessary information, and add new data. Therefore, users can conduct their investigations without getting lost in details. For example, we can detail any person or activity such as transaction details or previous transactions by clicking the right button and deleting unnecessary data on the visualization screen. These expanding functions are also called right-click actions. Datactive Query Language (DQL) provides to add functions and actions with zero-code.

Seemingly unimportant connections between entities have changed the results of many investigations. Data, that match the criteria entered as a filter on the scenario creation screen, is displayed on the result screen as a network. This is the most important reason why entity-link analysis is preferred for organized crime.

Conclusion

Datactive enables financial crime investigators to analyze complex and dynamic datasets and uncover hidden information in large volumes of data. DQL and alarm generation features eliminate the use of complex query languages and monitoring data constantly. In addition to providing actionable intelligence, Datactive supports investigators to make the right decisions by directing them to focus on the right points. It supports collective work and information sharing within the organization with its scaling capability.