The global pandemic threatened our health and affected our social life negatively. The development of an effective vaccine was the main goal. We discuss the role of AI in the development of the Covid-19 vaccine.

The global pandemic threatened our health and affected our social life negatively. The development of an effective vaccine was the main goal. We discuss the role of AI in the development of the Covid-19 vaccine.

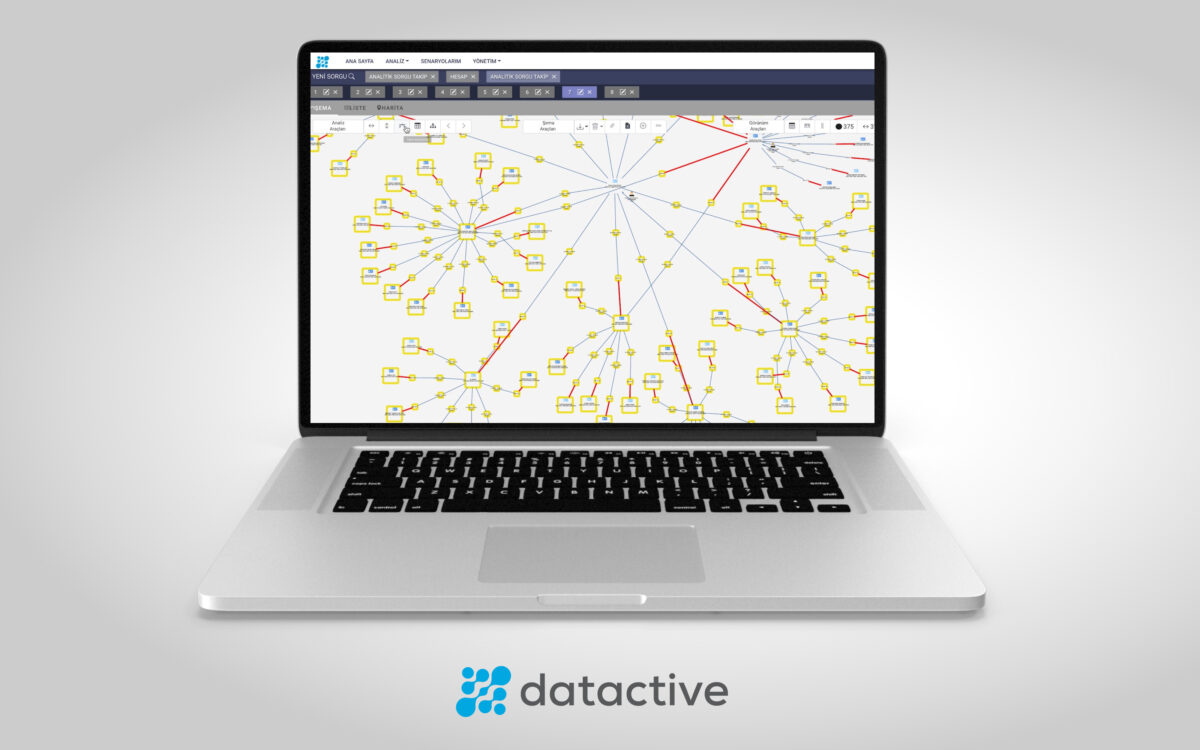

Financial crime intelligence systems differ from rule-based transaction monitoring systems, which monitor the transaction and cancel the transaction if fraud is suspected. In this article, we will examine the differences between them.

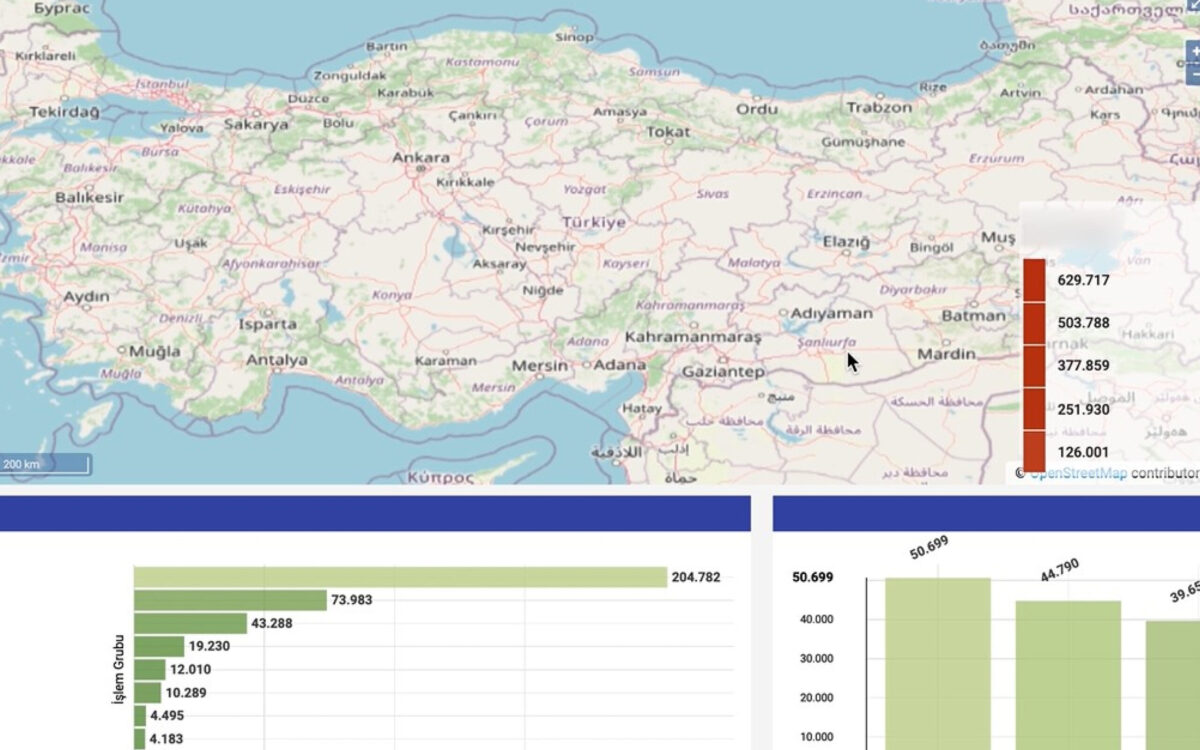

We often emphasize the geospatial analysis capability of our products and solutions. In this article, we explain the details of the geospatial analysis feature and its contributions to your analysis.

Data now explain themselves through various visualization methods instead of long and boring texts. For the reasons we will explain in this article, the most effective way of these visualization methods is interactive infographics.

The fraudulent methods are getting more complex due to technological developments. Hence, detecting illegal activities is also more complicated. The main target of the fraudsters, as you guess, is the financial sector.

We frequently emphasize the necessity of choosing the most appropriate data analytics solution to create a data-driven corporate culture in our previous articles.*

We know that graph theory is used in most computer modeling since its importance in solving problems with complex structures.

The insurance sector is a sector targeted by those who want to gain unfair profit. Insurance fraud constitutes 3.58% of all fraudulent activities.

While describing our BI solutions product, we use definitions such as “new generation business intelligence” and “the most modern decision support system”. There is a crucial transformation under the adjectives of “new generation” and “most modern”.

Different fraud methods are emerging with the developing technology. Detection of these methods with traditional data analysis is almost impossible.