The fraudulent methods are getting more complex due to technological developments. Hence, detecting illegal activities is also more complicated. The main target of the fraudsters, as you guess, is the financial sector.

The loss of banks because of fraud is more than we expect. In this blog post, we discuss the capabilities of Datactive for fraud detection.

First of all, banks and financial institutions still prefer traditional data analysis or manual scanning methods. However, the most common way of fraud is misdirecting transactions and embedding patterns in a lot of data from different sources. In this case, it is almost impossible to detect the critical points and to reveal the relationships with traditional data storage techniques for the detection of illegal activities. To uncover relationships in relational databases, data must be modeled as a series of tables and columns, and some complex joins need to be performed. For standard queries, this method may work, but for more complex queries this method misses the details.

Graph method allows to obtain up-to-date scenarios of customer behaviors and fraudulent activities and to take precautions against similar actions. The more different methods analysts detect, the more experienced they are in solving fraud. Datactive provides all capabilities of graph analytics and more, and all these capabilities are essential, especially in the banking and finance sectors.

The vast majority of fraudulent activities are not managed by a single person. These movements are mostly carried out by organized groups. The ability to reveal the hidden connections and patterns of relationship-oriented analytics method is the best way to discover the fraud rings. Organizations can simply track all their customers’ connections on a single interface. This capability not only detects fraud but also detects potentially suspicious transactions. For example, a leading multinational US investment bank is using advanced graph analytics to combat fraud. By adding graph analytics to their machine learning system, the organization can identify more suspicious patterns, detect organized fraud networks and close fraudulent cards much faster. This saves the bank millions of dollars a year.

Use Case:

Preventing anti-money laundering is also important for banks’ reputations and customer loyalty. Banks have obligations to track some money transfers, especially if the transfer is more than the determined amount. In illegal money transfers, fraudsters generally act as organized. Therefore, in order not to be caught in the standard audit procedures of banks, fraudsters use the pyramid method. This method defines that the total amount of money is divided and transferred through different accounts and at the end, collected in a single account. If the bank makes Datactive as a standard query procedure for such cases, information such as all transactions, account owners, amount of money, the dates and times of transfers, and also the other connections between account owners can be seen at once.

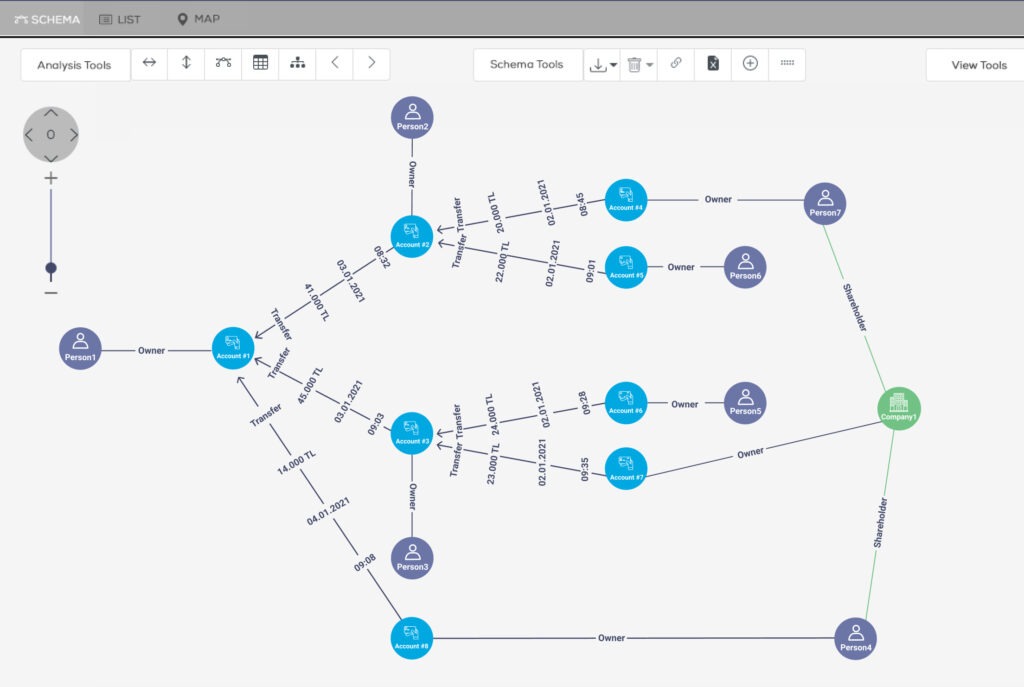

As we can see in the result screen below, it seems that money transfers to the suspicious account were made from two different accounts, and these two accounts received the money from two more different accounts. Moreover, person 4 at the bottom of the pyramid transferred the remaining amount to person 1, the owner of the account where the money was collected, a day after all transactions. Also, person 4 works in the same institution with person 7 who is at the bottom of the pyramid. This connection, which we can capture with a simple query, is a strong indication of money laundering.

Account takeover is another issue that causes the loss of customer confidence and loyalty for banks. Transactions made by different people or accounts over a single IP may be an indication of an account takeover. However, it is possible to detect account takeovers through a simple query on Datactive.

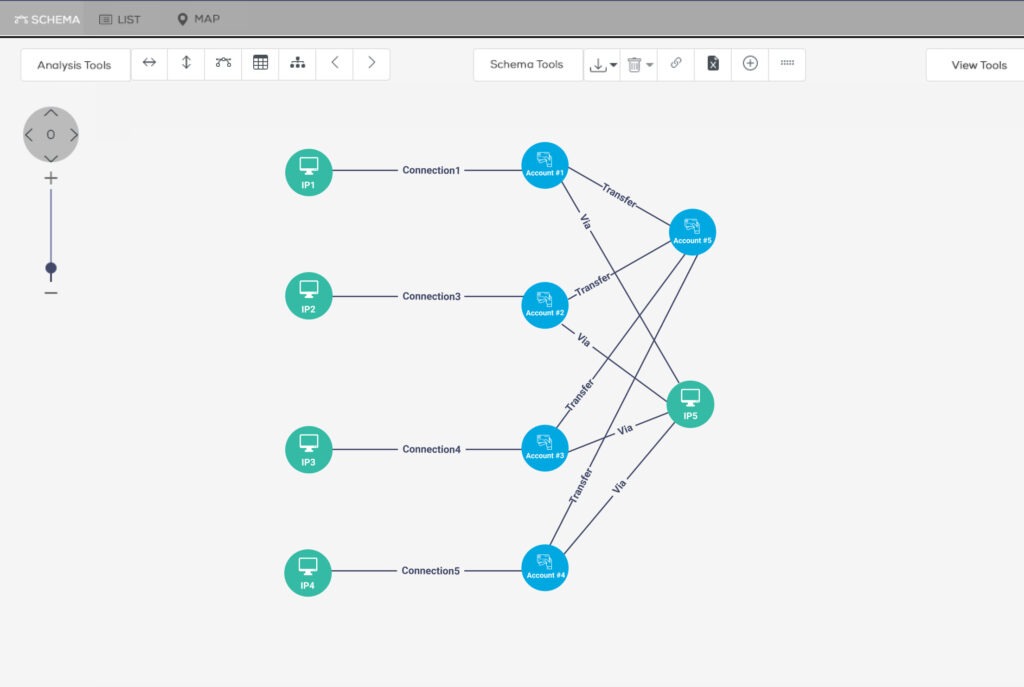

For example, in the results screen below, we find that money transfers from four different accounts to one account (Account5) are attempted to be made on a single IP. However, by examining the past transactions of four different accounts, we find that each account normally performs transactions from different IPs. In this result, accounts 5 and IP 7 may be suspicious. It strengthens the suspicion that these accounts were taken over by a single person and tried to transfer money to a single account.

Since fraud rings and methods are complex, manual or traditional methods may be insufficient for detection. Datactive is a product that is positioned to be your strongest solution partner for fraud detection. The visualization layer which offers rich link analysis capabilities enables you to view hundreds of thousands of nodes and edges in all modern web browsers and mobile. Moreover, it allows you to apply various graph analyses (degree centrality, betweenness centrality, etc.) to your result data. You can continue to expand your analysis by transferring your data from external data sources such as Excel to the interface by combining them with the results of online queries.