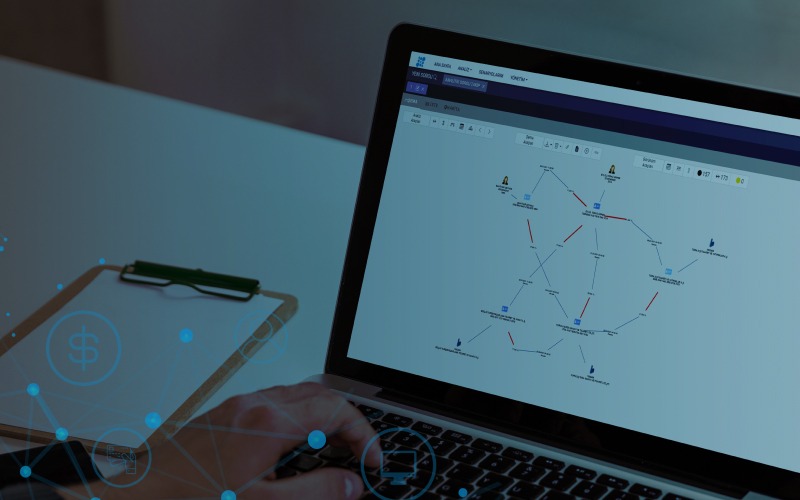

Money launderers can hide well to depict their transactions as legal. However, Datactive reveals hidden connections and patterns in data instantly, so crime rings are no longer invisible.

Money launderers can hide well to depict their transactions as legal. However, Datactive reveals hidden connections and patterns in data instantly, so crime rings are no longer invisible.

Many organizations take advantage of artificial intelligence and machine learning solutions. In this article, we discuss how graph technology empowers machine learning processes.

If financial crime organizations are not detected, they cost serious reputational damage and sanctions. The solution is a comprehensive crime intelligence system.

The fraudulent methods are getting more complex due to technological developments. Hence, detecting illegal activities is also more complicated. The main target of the fraudsters, as you guess, is the financial sector.

The insurance sector is a sector targeted by those who want to gain unfair profit. Insurance fraud constitutes 3.58% of all fraudulent activities.

Different fraud methods are emerging with the developing technology. Detection of these methods with traditional data analysis is almost impossible.

With Datactive, it is now possible to give a different answer to this question.

In our previous article, we discussed graph analytics which is the future data analysis technology. In this article, we mention the usage areas of this method in more detail.

One of the technologies that have come to the fore with the rapid rise of the big data concept in the last ten years is graph databases.

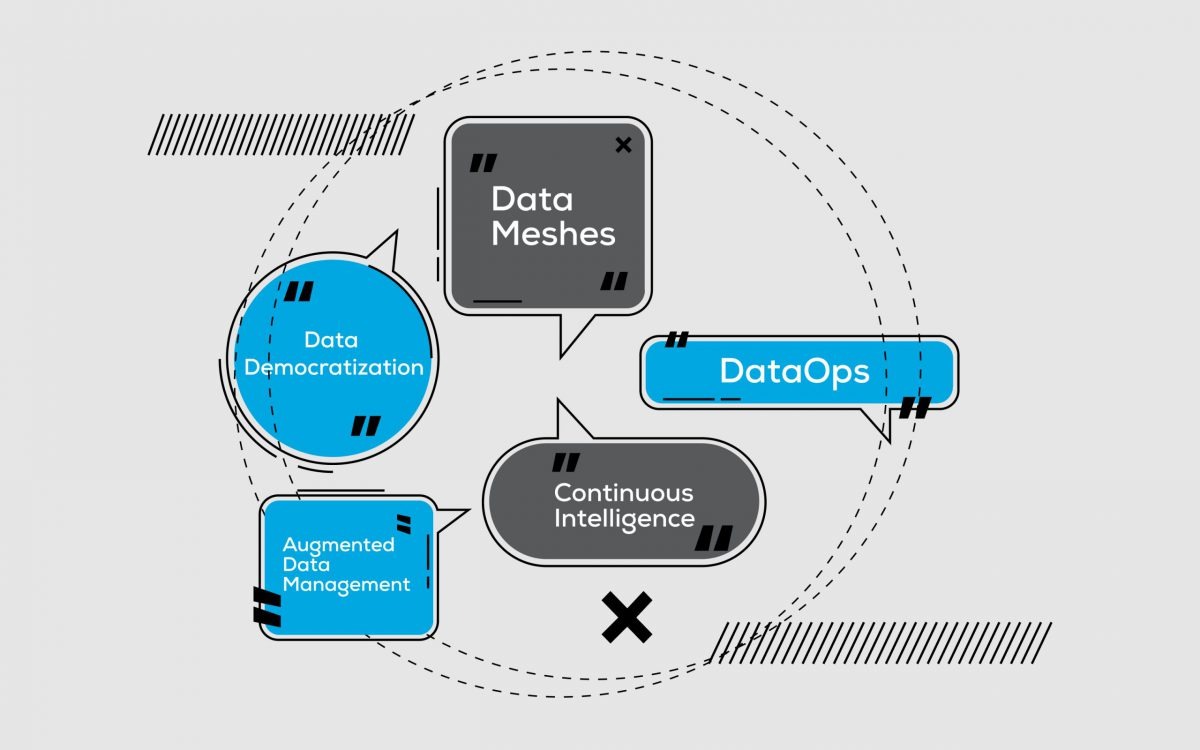

With the data-driven transformation, data analysis methods, must improve themselves to understand and evaluate the exponentially increasing data world. Even if these terms are already used in the sector, they will be heard more frequently in 2021. In this article, we define these terms briefly.